At the GGC annual meeting, Executive Vice President Scott Stofferahn presented a ‘preferred’ plan that would result in a reduction in Board members from 15 to 9 and Districts from 5 to 3. Stofferahn explained that the reduction could be accomplished over a two year period from 2020 to 2021 when current Directors reach their term limits for serving on the Board.

Stofferahn stated that the Board has not endorsed a plan, but they identified a preferred option to present to GGC members.

We ask that you read this entire story and complete the survey by clicking the Survey link at the bottom of the page.

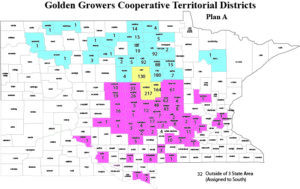

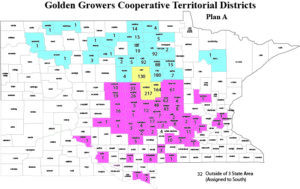

The preferred option would create Central, Northern, and Southern member districts. The Central District would include MN counties of Richland & Wilkin and the ND County of Cass. The Northern District would include counties in Minnesota and North Dakota north of Richland and Wilkin Counties (excluding Cass). The Southern District would include MN, ND, and SD counties south of Cass (excluding Richland and Wilkin) plus all members living outside of the three state area.

Central – 511 members

Northern – 553 members

Southern – 487 members

Two Directors would be elected from each District and three directors would be elected ‘at large’ from all districts.

Stofferahn shared research on Board size which indicated the following:

- Larger Boards: Allow for more member engagement; Are associated with complex organizations and outside directors; and Allow for greater continuity.

- Smaller Boards: Are more effective at monitoring the business of the organization; Tend to be more engaged; Result in improved decision making; and Cost less.

Stofferahn cautioned, “Not all large boards result in better member engagement. And not all small boards are more effective and engaged.”

According to a 2003 Survey of 437 Cooperatives, a 7 member board was most common.

At Large Board membership was a topic of discussion at the annual meeting. The advantage of allowing ‘at large’ board members would be to allow for a larger pool of candidates for three of the board positions. A disadvantage could be that a single district could be over represented on the Board.

Please share your thoughts about this proposal by clicking the following link:

Click Here > GGC Board Governance Survey