At the GGC annual meeting, Executive Vice President Scott Stofferahn presented a ‘preferred’ plan that would result in a reduction in Board members from 15 to 9 and Districts from 5 to 3. Stofferahn explained that the reduction could be accomplished over a two year period from 2020 to 2021 when current Directors reach their term limits for serving on the Board.

Stofferahn stated that the Board has not endorsed a plan, but they identified a preferred option to present to GGC members.

We ask that you read this entire story and complete the survey by clicking the Survey link at the bottom of the page.

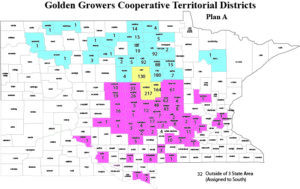

The preferred option would create Central, Northern, and Southern member districts. The Central District would include MN counties of Richland & Wilkin and the ND County of Cass. The Northern District would include counties in Minnesota and North Dakota north of Richland and Wilkin Counties (excluding Cass). The Southern District would include MN, ND, and SD counties south of Cass (excluding Richland and Wilkin) plus all members living outside of the three state area.

Central – 511 members

Northern – 553 members

Southern – 487 members

Two Directors would be elected from each District and three directors would be elected ‘at large’ from all districts.

Stofferahn shared research on Board size which indicated the following:

- Larger Boards: Allow for more member engagement; Are associated with complex organizations and outside directors; and Allow for greater continuity.

- Smaller Boards: Are more effective at monitoring the business of the organization; Tend to be more engaged; Result in improved decision making; and Cost less.

Stofferahn cautioned, “Not all large boards result in better member engagement. And not all small boards are more effective and engaged.”

According to a 2003 Survey of 437 Cooperatives, a 7 member board was most common.

At Large Board membership was a topic of discussion at the annual meeting. The advantage of allowing ‘at large’ board members would be to allow for a larger pool of candidates for three of the board positions. A disadvantage could be that a single district could be over represented on the Board.

Please share your thoughts about this proposal by clicking the following link:

Click Here > GGC Board Governance Survey

2019 Incentive Payments and Agency Fees

/in NewsIncentive Payments and Agency Fees for Method A and Method B Pool participation will remain the same for 2019. That means Golden Growers will pay $0.05 for Method A bushels delivered directly to the plant and will charge $0.02 for Method B bushels the Cooperative secures and delivers on a member’s behalf.

Share Your Thoughts on Board Governance

/in NewsAt the GGC annual meeting, Executive Vice President Scott Stofferahn presented a ‘preferred’ plan that would result in a reduction in Board members from 15 to 9 and Districts from 5 to 3. Stofferahn explained that the reduction could be accomplished over a two year period from 2020 to 2021 when current Directors reach their term limits for serving on the Board.

Stofferahn stated that the Board has not endorsed a plan, but they identified a preferred option to present to GGC members.

We ask that you read this entire story and complete the survey by clicking the Survey link at the bottom of the page.

The preferred option would create Central, Northern, and Southern member districts. The Central District would include MN counties of Richland & Wilkin and the ND County of Cass. The Northern District would include counties in Minnesota and North Dakota north of Richland and Wilkin Counties (excluding Cass). The Southern District would include MN, ND, and SD counties south of Cass (excluding Richland and Wilkin) plus all members living outside of the three state area.

Central – 511 members

Northern – 553 members

Southern – 487 members

Two Directors would be elected from each District and three directors would be elected ‘at large’ from all districts.

Stofferahn shared research on Board size which indicated the following:

Stofferahn cautioned, “Not all large boards result in better member engagement. And not all small boards are more effective and engaged.”

According to a 2003 Survey of 437 Cooperatives, a 7 member board was most common.

At Large Board membership was a topic of discussion at the annual meeting. The advantage of allowing ‘at large’ board members would be to allow for a larger pool of candidates for three of the board positions. A disadvantage could be that a single district could be over represented on the Board.

Please share your thoughts about this proposal by clicking the following link:

Click Here > GGC Board Governance Survey

GGC Approves Distribution of $0.14/bushel and passes $100 million in total distributions to members!

/in NewsOn June 15th, the Golden Growers Board of Directors approved a distribution of $2,168,667 to members of record as of June 1, 2018. This distribution is to be issued no later than June 30th. Total 2017 allocated income was $8,276,784 or roughly $0.53/bushel. In February, the Board issued a distribution to retire $2,493,967 of 2017 allocated income. This June distribution will retire $813,735 of remaining 2016 allocated income and $1,354,932 of 2017 allocated income for a combined total of $2,168,667 or $0.14/bushel.

As previously mentioned, the GGC Board believes it is important to build a reserve during the course of this new lease for several reasons that include likely capital expenditures at the plant, and the potential for Cargill to exercise its option to purchase 50% interest in ProGold. This distribution authorized by the Board will result in a remaining equity credit balance for 2017 of $4,427,885. With this payment, Golden Growers has issued payments to members totaling $100,875,160 or 186.9% of original investment in the ProGold plant.

Mark Dillon, GGC’s Executive VP during through 2012 said, “In 1996 the price for HFCS plummeted and we knew the losses could not be sustained for long. ProGold’s leadership found a solution by leasing the plant to Cargill on terms paid off the debt at the end of the 10 year lease. Some members wondered if they would ever see a return on their investment. But members who were patient have been rewarded for their confidence. For me, the best moment in our history was mailing that first cash distribution of more than 59 cents per share in August, 2008.” Dillon credited extraordinary leadership from the GGC and ProGold Boards during those challenging years.

Ethanol Groups Vent Frustration

/in NewsWhen EPA Secretary Pruit toured the states of South Dakota and Iowa in June, he was met by farmers protesting the Agency’s unwillingness to make good on a promise by President Trump to allow E15 to be sold all year round.

At issue is an EPA regulation on Reed vapor pressure (RVP) that effectively bans 15% ethanol fuel blends from being sold in most markets during the summer even though E15 has lower RVP emissions than gasoline sold in the same markets.

In April, 18 Senators (including all from ND, SD, & MN) signed a letter asking Pruit to expedite the rulemaking process on the President’s commitment. Yet two months later, there has been zero action by the EPA.

In the months preceding the Senators letter on E15, the EPA was aggressively granting ‘hardship’ waivers intended for smaller refiners that would otherwise face severe financial hardship complying with the Renewable Fuels Standard. Dozens of these waivers have been granted including Andeavor, one of the country’s largest refiners, and CVR Energy, owned by billionaire Carl Icahn. On June 6th, farm and renewable fuel groups petitioned the EPA to account for an estimated loss of 1.5 billion gallons in ethanol volume. “These lost volumes are having a negative effect on the nation’s corn growers at a time when net farm income is project to hit its lowest point in 12 years,” said NCGA President Kevin Skunes.

Ethanol groups expressed relief, however, that they succeeded to convince the White House not to proceed with a proposal to allow RIN credits for exports on renewable fuel. (Source: American Coalition for Ethanol & Growth Energy)

‘Looking Straight Ahead’ – Chairman’s Annual Report

/in NewsChairman Mark Harless explained details of the new ProGold lease to Cargill. In particular, he focused on Cargill’s ‘option’ to purchase 50% of ProGold. “Golden Growers signed an agreement consenting to the sale, pending a partnership agreement between Golden Growers and Cargill. Golden Growers has also secured the right to purchase 1% of ProGold from American Crystal Sugar if the option is exercised. The combination of actions would result in Golden Growers and Cargill becoming 50/50 owners of the Wahpeton corn wet milling plant.”

Harless went on to relay how this provision has resulted in more questions than any other part of the lease. He then highlighted three most common questions.

“First, there is no guarantee that Cargill will exercise their option. Cargill will likely make their decision based on market conditions and potential opportunities at the time.

We do not presume to know those conditions or the timing of any decision.”

“Second, to accommodate this option, Golden Growers and Cargill must agree on terms of partnership. We have agreed on general principles, but we will still need to, expeditiously and in good faith, finalize a partnership agreement in advance if Cargill informs us of their intention to exercise their option.”

“And third, details of any agreement between Cargill and American Crystal Sugar, including a purchase price, are confidential between those parties.”

Harless explained that the Board would be reviewing how to best achieve a fair and profitable partnership agreement and exploring financing options for various scenarios if Cargill exercises their option. “We look forward to engaging our members in those discussions.”

Executive Vice President’s Report

/in NewsThis is our first full year as a single employee organization, stated Scott Stofferahn, Golden Growers Executive Vice President. “We’ve been able to make it work through contracting with Eide Bailly for bookkeeping and by finding more efficient ways to do things. As a result, our administration expenses are down this year and are projected to be down again in 2018.” Stofferahn stated that GGC will save roughly $40,000 annually under terms of the new Grain Services Agreement with Cargill. And despite more SEC reporting associated with a new ProGold lease, overall SEC costs are lower than they have ever been.

Direct Deposit of distribution checks continues to grow with 506 members or 33% currently enrolled. “We will continue to encourage members to participate in this time and cost saving payment delivery method.”

Stofferahn reserved most of his time to discuss Board Governance – specifically a proposal to reduce the size of the Board from 15 members to 9 and reduce the number of districts from 5 to 3. “A preferred plan has been identified, but the Board has not endorsed a plan.” Any change would require a Bylaw amendment at the 2019 Annual meeting. Member comments in the Q&A session were generally supportive of the move. Stofferahn stated that he plans to provide an opportunity for more member feedback by placing a survey on the GGC Website and through an emailed questionnaire.

The 199A Federal Tax Provision (An Update)

/in NewsUPDATE: An agreement was reached and included in the Omnibus spending bill approved in late March. While the ‘fix’ has re-leveled the playing field, it too is complicated. Therefore, we’ll leave the explanations up to other sources and your tax accountant.

Related Article: How the Section 199A ‘Fix’ Will Work – April 6, 2018 DTN Progressive Farmer

PREVIOUS ARTICLE from Feb 4, 2018: Since the passage of federal tax legislation, a great deal of consternation has ensued about the 199A provision for cooperatives authored by Senators Hoeven and Thune. In oversimplified terms, producers who sell to a cooperative may deduct 20% of gross receipts from their business income compared to a 20% deduction against net income for sales to private firms.

GGC members are wondering if Method A deliveries qualify under this provision. The answer is NO. Because GGC is formed as a MN 308B cooperative, our tax identify is that of a partnership that does not qualify under this provision.

It is unclear if this tax law, with unintended consequences, can be resolved any time soon. Cooperatives want similar treatment to the older 199 provision AND parity with a 40% corporate tax cut to private entities. Stakeholders are meeting, but as of this time, no agreement has been reached.

If a fix can be agreed to, it must then be attached to legislation that passes both houses of Congress – a somewhat difficult task. Meanwhile, a great deal of market disruption and ‘sham’ coop development may occur.

For more detailed background on the 199A tax provision and its potential consequences review Farm Doc Daily’s Post Titled: A Discussion of the Sec 199A Deduction

Annual Meeting Set for March 29th in West Fargo

/in NewsGolden Growers Annual Meeting – Thursday, March 29

The Golden Growers Annual Meeting is set for Thursday, March 29, 2018 at the DoubleTree Conference Center 825 E Beaton Drive, West Fargo, ND. The Doubletree is located on the north side of Interstate 94 where it intersects with Veterans Boulevard.

The schedule is as follows:

8:00 a.m. Registration and Continental Breakfast

9:00 a.m. Short Courses

10:00 a.m. Business Meeting

11:00 a.m. John Bode, President of the Corn Refiners Association

12:00 p.m. Lunch

1:00 p.m. Members Only Question & Answer Session

CRA President, John Bode to speak at Annual Meeting

/in NewsSince 2013, Mr. Bode has served as the President of the Corn Refiners Association, a national association representing the corn wet milling industry of the United States. He has been involved in every significant change in federal food law since the 1981 Farm Bill.

Bode served in three Presidential appointments at the U.S. Department of Agriculture, including Assistant Secretary of Agriculture for Food and Consumer Services. Before joining the USDA in 1981, he was on the staff of the U.S. Senate Committee on Agriculture, Nutrition, and Forestry, and served on the staff of then-Governor of Oklahoma David L. Boren.

GGC Board Allocates 2017 Income, Announces Payment to Retire Equity Credit

/in NewsOn February 3, 2018, after review of the 2017 end of year financial and income statements, the Board of Directors allocated income of $8,276,784 to the members of Golden Growers Cooperative. The Board also approved the retirement of a portion of allocated equity credit in an amount of $0.161 per patronized bushel for a total of $2,493,967. This payment represents 30% of 2017 allocated income as required by the bylaws of Golden Growers Cooperative.

Payments are anticipated to be issued to Golden Growers members in mid February.